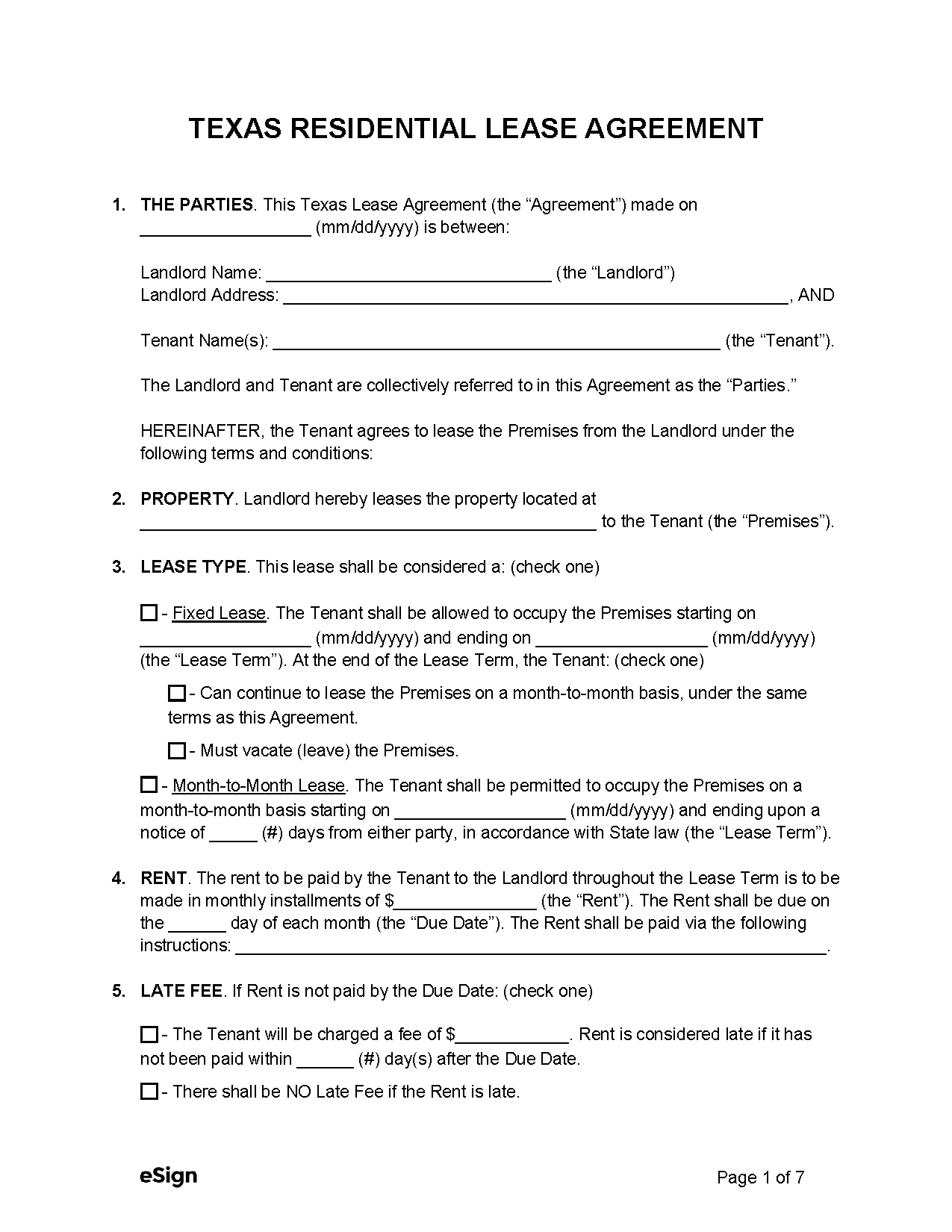

A Texas lease agreement is a contract that grants a tenant the right to occupy a residential or commercial property in exchange for the payment of rent. Every type of lease agreement includes the terms and conditions of leasing property, such as the monthly cost, additional fees, rules and guidelines, and state-required disclosures.

A Texas lease agreement is a contract that grants a tenant the right to occupy a residential or commercial property in exchange for the payment of rent. Every type of lease agreement includes the terms and conditions of leasing property, such as the monthly cost, additional fees, rules and guidelines, and state-required disclosures.

PDF Download

A Texas lease agreement is a contract that grants a tenant the right to occupy a residential or commercial property in exchange for the payment of rent. Every type of lease agreement includes the terms and conditions of leasing property, such as the monthly cost, additional fees, rules and guidelines, and state-required disclosures.

4.5 | 209 Ratings Downloads: 29,658

Rental Application – Completed by a tenant to share their personal and employment details with a landlord to authorize a background check.

Maximum Amount ($) – There are no Texas statutes that impose a maximum security deposit limit.

Collecting Interest – State statutes do not mention the collection of interest on security deposits.

Returning to Tenant – Security deposits must be returned 30 days after the tenant gives up possession of the property to the landlord. [8]

Itemized List Required? – Yes, if the landlord uses some or all of the security deposit to fix damages other than normal wear and tear, they must provide the tenant with a list of all deductions. [10]

Separate Bank Account? – No, state law does not specify whether security deposits must be kept in a separate bank account, only that landlords must maintain accurate records. [11]

General Access – Texas property code doesn’t specifically mention the need to notify tenants before a landlord enters the premises.

Immediate Access – Not mentioned in state statutes. The Tenants Rights Handbook (page 6), however, states that it is acceptable for a landlord to enter a tenant’s rental unit only in emergency situations and for routine inspections/repairs. In the latter case, notice is still recommended.

Grace Period – There is a two-day grace period before a landlord can collect a late fee from a tenant. Furthermore, the fee must be reasonable and written in the lease agreement. [12]

Maximum Late Fee ($) – A late fee is considered reasonable if it is 12% of the rent amount when the rental property has four units or less. When the building has more than four units, 10% is considered reasonable. [13]

Bad Check (NSF) Fee – Fees charged to tenants for bounced checks are not covered by state law.

Withholding Rent – A tenant cannot legally withhold rent payments. If they do, the landlord can recover damages equal to one month’s rent plus $500 after proper notice has been delivered. [15]

Non-Payment of Rent – If a tenant fails to pay rent, the landlord must give them three days notice to pay or vacate the premises before starting an eviction suit. [16]

Non-Compliance – If a tenant breaches their lease agreement, the landlord must deliver a 3-day notice to comply or quit before they can file for eviction.

Landlord Repairs – Besides normal wear and tear caused by the tenant, the landlord should be notified by the tenant of any necessary repairs that affect their health or safety. [17]

Lockouts – Landlords cannot lock a tenant out of their rental property without proper judicial process or for legitimate reasons listed under state law. [18]

Leaving Before the End Date – A landlord’s remedies for a tenant abandoning rental property before the lease has terminated are not mentioned in state statutes.

Month-to-Month – In order to end a month-to-month tenancy, either party must deliver a 1-month notice to quit to the other. [19]

Unclaimed Property – If a tenant leaves their property in the rental unit, the landlord may remove it. No storage or timeframe for recovery is mentioned in state statutes. [20]